Characteristics of the asset class

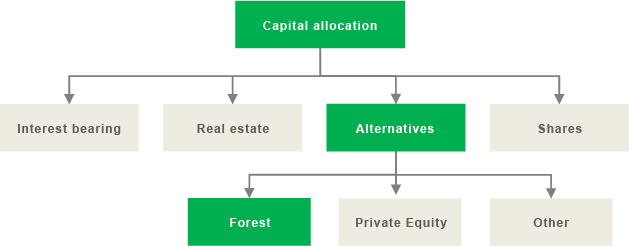

- In recent years there has been an increased interest in alternative investments, with forestry as one of the asset classes

- Forestry offers an opportunity to diversify and therefore forms a natural component in a broad, long-term investment portfolio. Investing in forestry, especially direct investment, has a low correlation with the stock market and offers less volatility than other asset classes.

- A stable, secure and sustainable cash flow is characteristic of the forestry sector.

- Cash flow is generated for the most part by net earnings from forestry activities (Skogsnetto), which over the past ten years has exceeded the rate of inflation.

- The return on forestry investment consists of two parts: a direct return (cash flow component) and value growth.

- Value growth is determined by supply and demand, price changes and changes in the growing stock and its composition.